APPLY

Simply fill our application

form, it takes less than 5 mins to

get started! We start working on

your application right after the submission.

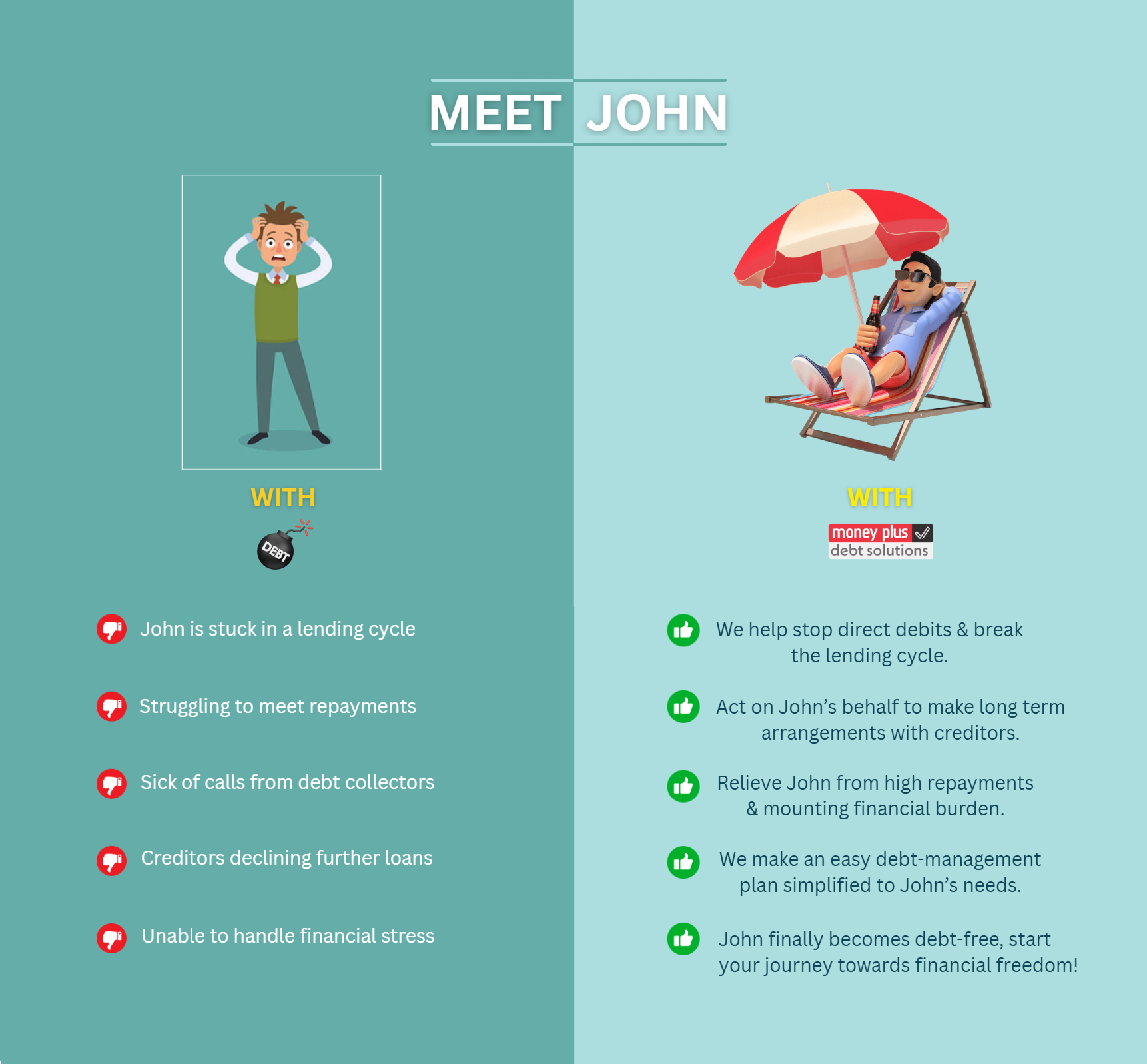

LET US HANDLE

We will handle everything for you!

Our team will act on your behalf & talk with

creditors, pause/freeze ongoing payments,

and come up with the best monthly plan

for you with just one affordable payment.

BE DEBT FREE

Enjoy peace of mind knowing your debt is being

effectively managed. Complete your Informal

Debt Arrangement, and leave your debts

in the past where they belong.